When the first generic version of a brand-name drug hits the market, it doesn’t mean the battle is over-it’s just getting started. The real chaos begins when other companies jump in. In the U.S., the Hatch-Waxman Act gives the first generic manufacturer 180 days of exclusive rights to sell the drug after successfully challenging a patent. During that window, they charge 70-90% of the brand’s price and capture 70-80% of the market. But once that clock runs out, everything changes. Competitors flood in. Prices crash. And the market turns into a race to the bottom.

How the First Generic Wins-Until It Doesn’t

The first generic to file an Abbreviated New Drug Application (ANDA) and win a patent challenge gets a huge advantage. They’re the only ones allowed to sell the drug for six months. That’s not just a head start-it’s a profit machine. Companies spend $5-10 million on litigation just to get this shot. And it pays off. With no competition, they sell at near-brand prices. For a drug like Crestor (rosuvastatin), that meant $320 per month before generics. After the first generic entered, it dropped to $90. Still high, but now the first company was making bank. But here’s the catch: that exclusivity isn’t a shield. It’s a target. Brand companies know what’s coming. So they often launch an authorized generic-a version made by the original brand but sold under a generic label-right when the first generic hits. In the Januvia (sitagliptin) market, Merck did exactly that in December 2019. On day one, their authorized generic captured 32% of sales. The first generic’s market share dropped from 80% to under 50%. Revenue? Down 35%. The first mover didn’t lose the race-they got sucker-punched before the finish line.Why the Second, Third, and Fourth Generics Crash the Party

After the 180-day window, the floodgates open. The FDA approves more ANDAs. Companies that waited-sometimes years-now jump in. They don’t need to re-prove bioequivalence. They piggyback on the first generic’s work. That cuts their development costs by 30-40%. But they face new hurdles: getting samples, dealing with citizen petitions, and negotiating with pharmacy benefit managers (PBMs). The price drop isn’t gradual. It’s explosive. With one generic, prices sit at 83% of the brand. Two generics? 66%. Three? 49%. Four? 38%. Five or more? Down to 17%. The steepest plunge happens between the second and third entrants. That’s when the market flips from premium to bargain. In 2016, eight companies sold generic Crestor. The monthly price fell to $10. That’s a 97% drop from the brand’s original cost. Not all drugs fall this far. Oncology generics, because they need special handling and storage, hold at 35-40% of brand price even with five competitors. CNS drugs like antidepressants hover around 20-25%. But cardiovascular drugs? They drop to 12-15%. Why? Because they’re simple to make. Easy to replicate. And everyone wants a piece.The Hidden Game: PBMs, Formularies, and Winner-Take-All Contracts

Getting FDA approval is only half the battle. The real power lies with pharmacy benefit managers-companies like CVS Caremark, Express Scripts, and UnitedHealth’s OptumRx. They control which drugs get covered by insurance. And they don’t care who got approved first. They care about price. In 2023, 68% of generic drug contracts used a “winner-take-all” model. That means the lowest bidder gets 100% of the formulary placement. The first generic might have been first to market, but if the third generic offers a 20% lower price, they get all the sales. It’s not about timing anymore. It’s about who can cut costs the most. That’s why some companies now focus on being “efficiency players”-small manufacturers with lean operations that can undercut everyone else. Others become “innovation players,” targeting complex generics like inhalers or injectables where fewer competitors can enter. But for the simple pills? It’s a bloodbath.

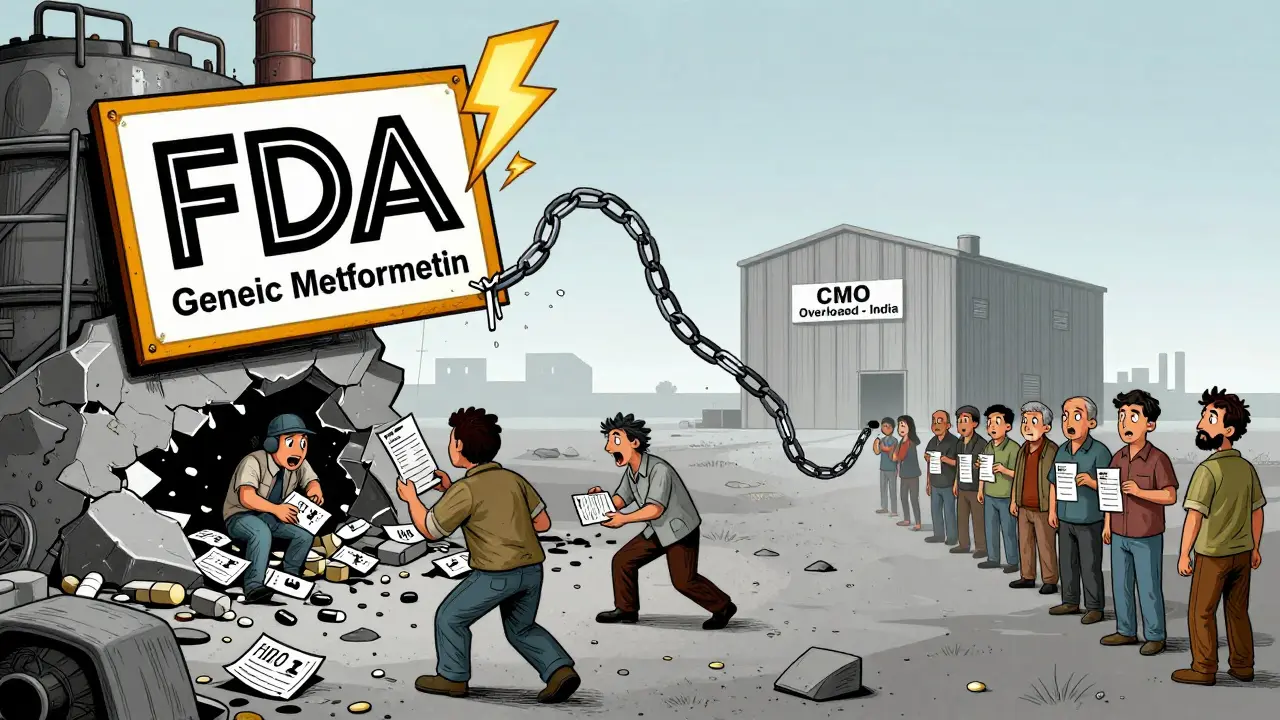

Manufacturing: The Weak Link

The more competitors, the more pressure on contract manufacturing organizations (CMOs). First generics often own their own facilities. Later entrants? They rent space. In 2022, 78% of second-and-later generic manufacturers relied on CMOs, compared to just 45% of the first entrant. That sounds smart-lower upfront cost. But it’s risky. The FDA reported that 62% of generic drug shortages involved products with three or more manufacturers. Why? Because CMOs get overloaded. One quality issue at a single plant can shut down supply for half the market. In 2022, a single facility in India had a sanitation violation. It took out generic metformin for months. Millions of diabetics scrambled. And it’s getting worse. The number of active ANDA holders dropped from 142 in 2018 to 97 in 2022. Companies are quitting. Why? Because the margins are too thin. If you’re selling a pill for 5 cents, and your shipping cost is 3 cents, you’re not making money. You’re just surviving.Patent Games and Staggered Entry Deals

Brand companies aren’t just sitting back. They’re playing chess. In 2022, there were 147 patent settlement agreements. Sixty-five percent included clauses for staggered generic entry. Instead of letting all generics come in at once, they agree to spread them out over years. Take Humira (adalimumab). Six biosimilar manufacturers agreed to enter between 2023 and 2025, one every few months. That keeps prices from collapsing overnight. It gives the brand time to transition to its own biosimilar. It keeps the market stable-for now. But this isn’t fairness. It’s control. The brand company pays the generic makers to delay. The FTC calls it “pay-for-delay.” The industry calls it “strategic timing.” Either way, patients wait longer for the lowest prices.

The Bigger Picture: Why This System Is Broken

The U.S. is the only major country that lets drug prices drop this fast. In Germany, prices stabilize at 25-30% of brand. In Japan, it’s 35-40%. In the U.S.? 10-15%. That’s because PBMs drive competitive bidding. They pit manufacturers against each other. The lowest bid wins. No matter who it is. But there’s a cost. Shortages. Market exits. Consolidation. Between 2018 and 2022, the average number of competitors in multi-generic markets fell from 5.2 to 3.8. Why? Because too many companies entered too fast. Then prices crashed. Then they left. Experts like Dr. Aaron Kesselheim at Harvard say the system creates perverse incentives: too many players chasing too little profit. Dr. Scott Gottlieb, former FDA commissioner, argues for market-based fixes-like long-term contracts or restricted entry for simple generics. Without change, we’ll keep seeing the same cycle: boom, crash, shortage, exit.What’s Next? The Future of Generic Competition

By 2027, 70% of simple generic markets will have five or more competitors-with prices at 10-15% of brand. Complex generics? Two or three players. Prices at 30-40%. Authorized generics? Half of the top-selling drugs will have one by then, up from 25% today. The companies that survive won’t be the ones with the biggest labs. They’ll be the ones with the best supply chains, the tightest cost controls, and the strongest relationships with PBMs. The ones who can’t adapt? They’ll disappear. And the patients? They’ll get cheaper drugs-but sometimes, they won’t get them at all.3 Comments

Stacy Thomes

January 24 2026

THIS IS WHY MEDICINES ARE UNAFFORDABLE. The system is rigged. First guy works his ass off, gets the patent challenged, and then gets buried by 10 companies who didn’t lift a finger. It’s not capitalism-it’s a bloodsport. Someone needs to fix this.

dana torgersen

January 24 2026

you know... it’s like... life, right? the first one to jump gets the prize... but then everyone else just... copies... and then it’s all... chaotic... and no one wins... except maybe the PBMs... who just... sit there... with their spreadsheets... laughing...?

Vanessa Barber

January 23 2026

Everyone acts like this is new, but it’s been this way since the 90s. The first generic gets rich, then gets crushed. The system doesn’t reward innovation-it rewards who can undercut the hardest. And patients? They’re just collateral.