When you’re on multiple medications for high blood pressure, diabetes, or cholesterol, you might notice something strange: your insurance covers two separate generic pills for $10 each, but the generic combination pill that contains the same two drugs costs $50. Why? It’s not a mistake. It’s how insurance formularies work-and it can cost you hundreds a year if you don’t understand it.

What Exactly Is a Generic Combination Drug?

A generic combination drug is a single pill that contains two or more active ingredients, all of which are generic versions of brand-name drugs. For example, a common high blood pressure combo might include amlodipine and benazepril. Instead of taking two pills, you take one. These are often called "fixed-dose combinations" (FDCs). They’re designed to simplify treatment, reduce pill burden, and improve adherence. The FDA says these combinations are just as safe and effective as taking the individual drugs separately. They must meet the same bioequivalence standards. But here’s the catch: insurance companies don’t always treat them the same way.How Insurance Tiers Work (And Why It Matters)

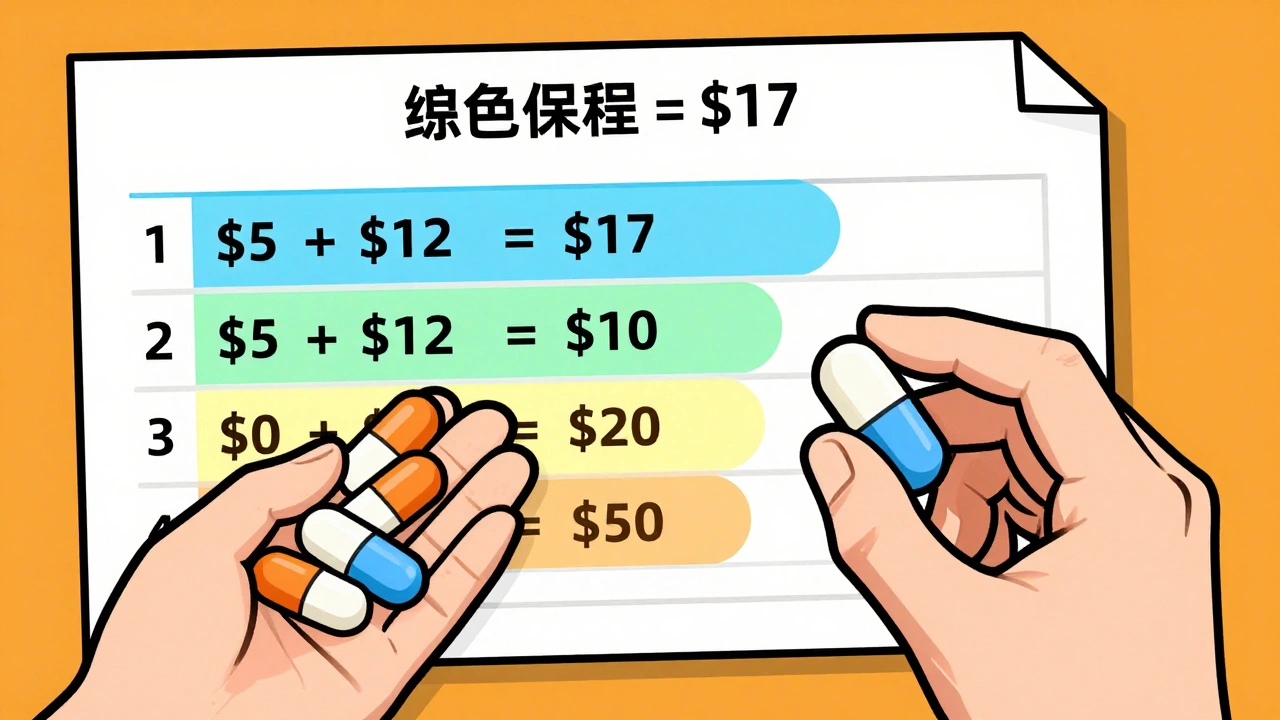

Most Medicare Part D and private insurance plans use a tiered system to control costs. Here’s how it typically breaks down:- Tier 1: Preferred generics-lowest copay, often $0 to $5

- Tier 2: Non-preferred generics or preferred brand-name drugs-$10 to $20

- Tier 3: Non-preferred brand-name drugs-$40 to $70

- Tier 4: Specialty drugs-$100+

The Hidden Cost Trap: Two Generics Can Cost More Than One Combo

Let’s say your doctor prescribes a generic combo pill: amlodipine 10mg + benazepril 20mg. The single pill costs $7 per month with your insurance. Now, your plan doesn’t cover the combo. But it covers the two individual generics: amlodipine at $5 and benazepril at $12. That’s $17 per month. You’re paying more for two pills than you would for one. This isn’t rare. A 2022 analysis of Medicare Part D plans found that 84% of drug combinations were covered only with generics-but coverage didn’t mean equal treatment. Many plans put combo drugs in higher tiers than the sum of their parts. That’s because insurers assume patients will split the dose. But what if you forget one pill? What if you can’t swallow two pills at once? What if you’re on eight medications already? Real people are paying the price. One Reddit user in June 2023 wrote: "My plan covers the individual generics for $10 each but the combination product would be $50 even though it’s the same ingredients-had to ask my doctor to write two separate prescriptions to save money." Meanwhile, another user in September 2023 shared: "When my blood pressure combo drug went generic, my out-of-pocket dropped from $45 to $7 per month with no change in effectiveness." The difference? One plan treated the combo like a single low-cost generic. The other treated it like a brand-name drug.

Why Do Insurers Do This?

There are three main reasons:- Cost control through fragmentation: If you’re buying two separate generics, the insurer can negotiate lower prices with different manufacturers. A combo pill is one product-one negotiation.

- Formulary complexity: Many pharmacy benefit managers (PBMs) like CVS Caremark and OptumRx use automated systems that don’t always recognize that a combo drug is just two generics in one. So they default to higher tiers.

- Historical inertia: When combo drugs first came out, they were brand-name and expensive. Insurers never updated their rules when generics arrived.

Single-Source Generics: The Exception That Breaks the Rule

Not all generics are cheap. Some are "single-source generics," meaning only one company makes them. Without competition, prices don’t drop. These are common with older combo drugs where patents expired but no other manufacturer stepped in. In those cases, the combo might cost more than the individual generics-not because of insurance design, but because the generic manufacturer is charging more. This happens more often than people realize. Truveris reports that single-source generics can cost up to 50% more than multi-source generics. That’s why checking your plan’s formulary isn’t enough. You need to know if the generic combo is made by multiple manufacturers-or just one.

What You Can Do: Five Steps to Save Money

1. Check your plan’s formulary-not just the drug name, but the exact brand and generic versions. Use the Medicare Plan Finder or your insurer’s website. Look for the drug under "combination" and "individual components." 2. Compare total monthly costs. Add up the copays for two separate generics. Compare it to the combo. If the combo is cheaper, ask your doctor to prescribe it. 3. Ask for a prior authorization. If your plan denies the combo, your doctor can submit a coverage determination request. Many plans approve it if you explain that taking two pills is difficult or that adherence is poor. 4. Switch plans during open enrollment. Not all plans treat combos the same. In 2024, some Part D plans had $0 copays for preferred combo generics. Others charged $30. The difference can be $300 a year. 5. Use GoodRx or SingleCare. Even if your insurance won’t cover the combo, you might find it cheaper out-of-pocket. One 2023 check showed a generic combo pill priced at $12 with GoodRx-less than the copay for two separate generics on some plans.What Changed in 2024?

The Inflation Reduction Act eliminated Medicare Part D deductibles and capped out-of-pocket spending at $2,000 per year. That helps everyone-but it doesn’t fix tier disparities. If your combo is in Tier 3 and your individual generics are in Tier 1, you’re still paying more until you hit that $2,000 cap. Also, a September 2023 court ruling banned "copay accumulator" programs. These programs used to prevent manufacturer coupons from counting toward your deductible. Now, if you get a coupon for a combo drug, it counts. That makes combo drugs more affordable, even if they’re not in Tier 1.The Bigger Picture: Why This Matters

The U.S. fills 90% of prescriptions with generics. That’s good. But if we’re going to rely on generics to control costs, we need consistent rules. Why should taking one pill cost more than taking two? It doesn’t make sense medically or financially. Combination drugs aren’t just a convenience-they’re a tool to improve health outcomes. Studies show patients are 20% more likely to stick with their regimen when they take one pill instead of two. That means fewer hospital visits, fewer complications, lower long-term costs. Insurance plans need to catch up. Until they do, you have to be your own advocate.Next time you get a prescription for a combo drug, ask: "Is this covered as a single generic?" If not, ask your pharmacist: "Can I get the two components cheaper?" And if the answer is still no, ask your doctor to file a prior authorization. It’s not just about saving money-it’s about making sure your treatment works.

Why is my generic combination drug more expensive than the individual generics?

Some insurance plans place combination drugs in higher tiers because they assume you’ll buy the two separate generics instead. Even though the ingredients are the same, the combo pill might be treated like a brand-name drug in the formulary. Always compare the total cost of two separate generics versus the combo pill before assuming the combo is more expensive.

Can I ask my doctor to prescribe two separate generics instead of the combo?

Yes, you can. If the individual generics are cheaper under your plan, your doctor can write separate prescriptions. This is common for high blood pressure, diabetes, and cholesterol meds. Just make sure your pharmacist knows you want the generics and not the combo version, and confirm the total monthly cost is lower.

Does Medicare Part D cover generic combination drugs?

Yes, but coverage varies by plan. In 2019, 84% of Medicare Part D plans covered only generic drugs, but not all placed combo drugs in the lowest tier. Some put them in Tier 2 or higher. Always check your plan’s formulary using the Medicare Plan Finder tool to see exactly where your combo drug is listed.

What’s the difference between a single-source generic and a multi-source generic?

A single-source generic is made by only one manufacturer, so there’s no price competition. These can cost more-sometimes nearly as much as brand-name drugs. Multi-source generics have multiple manufacturers competing, which drives prices down. Always check how many companies make your generic combo; if it’s just one, the price may not be as low as expected.

How can I find out if my drug is in a higher tier than it should be?

Call your insurance plan’s customer service and ask: "Is this combination drug covered under Tier 1 as a generic?" If they say no, ask for the formulary tier number. Then compare it to the individual components. If the combo is in a higher tier but the ingredients are the same, you can request a coverage determination. Many plans approve it if you show it improves adherence or lowers total cost.

Are generic combination drugs as effective as brand-name combos?

Yes. The FDA requires generic combination drugs to be bioequivalent to the brand-name version-meaning they work the same way in your body. They contain the same active ingredients, in the same strength, and are taken the same way. The only differences are in inactive ingredients, which rarely affect how the drug works.

9 Comments

Deborah Andrich

December 14 2025

I had this exact issue with my dad's blood pressure meds. He forgot one pill every other day until we switched to the combo. His numbers stabilized in two weeks. Insurance didn't care. I had to call 17 times to get prior auth. Worth it.

Tommy Watson

December 15 2025

LOL imagine paying more for ONE pill. This is why America sucks. PBMs are crooks. Pharma is worse. And you think you're getting generics? Nah. You're getting scammed with a side of bureaucracy. #MedicareScam

Donna Hammond

December 16 2025

Many people don't realize that combination drugs are often bioequivalent to their individual components-but insurers treat them like new drugs. Always check the National Drug Code (NDC) for each version. If the active ingredients match, you have a strong case for prior authorization. Also, GoodRx often has combo prices lower than your copay for two separate pills. Don't assume-always compare.

I've helped over 200 patients navigate this. It's not about fighting the system-it's about knowing how it works. You're not alone.

Richard Ayres

December 18 2025

It's worth reflecting on the broader implications here. The healthcare system incentivizes fragmentation over integration, even when integration improves outcomes. If a single pill increases adherence by 20%, as the article states, then the cost disparity is not just illogical-it's ethically questionable. Perhaps the real issue isn't insurance tiers, but the misalignment of financial incentives with public health goals.

Sheldon Bird

December 18 2025

My wife just switched to the combo pill last month and now she actually takes her meds. 🙌 I didn't even know this was a thing until I read this. Thanks for sharing. GoodRx saved us $40/month. Life changing.

Karen Mccullouch

December 19 2025

USA still the best? Nah. This is why I'm moving to Canada. Pay $10 for a combo pill there. Here? You're lucky if you don't get billed for the privilege of being sick. #MedicareIsBroken

Michael Gardner

December 21 2025

Wait-so you're saying the combo isn't always more expensive? I've been told the opposite for years. Maybe the article is just cherry-picking examples. My combo costs $65 and the two generics are $8 each. So... what's the real story?

Willie Onst

December 21 2025

Man, I'm from Texas and I thought we were bad. This is wild. I had no idea people were paying more for convenience. My grandma takes six pills a day and she's 82. Imagine if she had to take 12. That's not healthcare, that's a punishment. Thanks for pointing this out-gotta tell my uncle about this. He's on the same meds.

Webster Bull

December 12 2025

So you're telling me I'm getting charged extra for not being able to swallow two pills at once? That's not healthcare, that's a tax on laziness. And I'm not lazy-I'm just tired of juggling pills like a circus act.