Brand-name drugs can cost hundreds - sometimes over a thousand - dollars a month. If you’re insured but still struggling to pay for your medication, you’re not alone. Many people with private insurance rely on manufacturer savings programs to bring those prices down. These programs aren’t charity - they’re tools used by drug companies to help patients afford expensive brand drugs while keeping them from switching to cheaper generics. But for you, they’re a lifeline.

What Are Manufacturer Savings Programs?

These are financial help programs offered directly by drug makers like AbbVie (Humira), Roche (Ocrevus), or Sanofi (Jardiance). They come in two main forms: copay cards and patient assistance programs (PAPs). Copay cards are the most common. They’re digital or physical cards you use at the pharmacy to cut your out-of-pocket cost - often by 70% to 85%. For example, if your insulin costs $562 a month, a manufacturer coupon might drop it to $100. That’s not a small difference. It’s the difference between taking your medicine and skipping doses.Patient assistance programs are different. They’re usually for people with very low income or no insurance at all. But for most people with private insurance, the copay card is what matters.

These programs exploded after 2005, as insurance plans started making patients pay more upfront. By 2023, nearly one in five prescriptions for privately insured patients used a manufacturer coupon. That’s $23 billion in savings paid out by drug companies in a single year. But here’s the catch: if you’re on Medicare, Medicaid, or any other federal program, you can’t use these cards. It’s illegal.

Who Can Use These Programs?

You can only use a manufacturer savings program if you have private health insurance - not Medicare, Medicaid, VA, or Tricare. That’s because federal law bans drug makers from giving discounts to people on government programs. It’s meant to stop them from pushing expensive drugs on taxpayers. So if you’re on Medicare Part D, these cards won’t work for you - even if your plan doesn’t cover your drug well.Even if you have private insurance, not every plan lets you use these cards. Some insurance companies have something called an “accumulator adjustment program.” That means the manufacturer’s discount doesn’t count toward your deductible or out-of-pocket maximum. So even though you’re paying less each month, you’re still stuck hitting your deductible later. That can cost you thousands if you need surgery or hospital care. Check your plan documents or call your insurer to find out if they use accumulators.

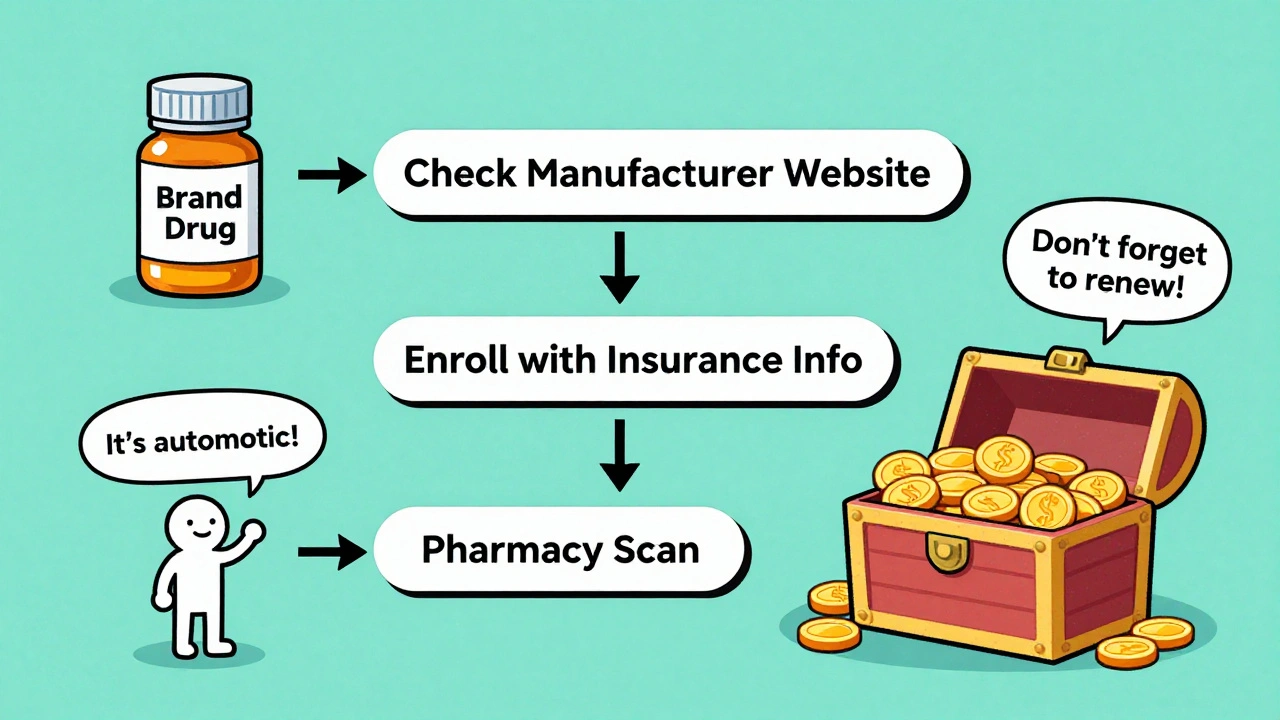

How to Find Your Drug’s Savings Program

Start by going to the drug manufacturer’s website. Type in the name of your medication, then look for “Patient Support,” “Savings Program,” or “Copay Card.” Most big drug companies have a dedicated page for this. If you’re not sure who makes your drug, check the label or ask your pharmacist.Or use a free aggregator site like GoodRx. They list manufacturer programs alongside their own pharmacy discount cards. GoodRx found that 73% of major drug makers have their own savings portals. You can compare options side by side.

Once you find the right program, click “Enroll.” You’ll need to provide:

- Your full name

- Your date of birth

- Your insurance info (plan name, member ID)

- Your prescriber’s name and contact details

- Your pharmacy’s name

It takes less than 10 minutes. After you submit, you’ll get a confirmation email with a digital card - sometimes a barcode, sometimes a membership number. Save it on your phone.

How It Works at the Pharmacy

When you go to pick up your prescription, tell the pharmacist you’re using a manufacturer copay card. They’ll scan your card or enter your ID number into their system. Their pharmacy software connects to a third-party administrator - companies like ConnectiveRx or Prime Therapeutics - which checks your eligibility in real time.If you qualify, the discount is applied immediately. You pay only your reduced copay. The manufacturer pays the rest to the pharmacy through the third-party processor. You don’t need to file claims. You don’t need to wait for reimbursement. It’s automatic.

But here’s what can go wrong:

- Your insurance plan blocks the card because of an accumulator program.

- The pharmacy doesn’t accept the card (rare, but happens with small or independent pharmacies).

- You’re enrolled in the wrong program - maybe you used a generic version by mistake.

If the discount doesn’t show up, ask the pharmacist to check the claim status. Sometimes it’s a simple system glitch.

What Are the Limits?

These programs aren’t unlimited. Most cap annual savings between $5,000 and $15,000 per person. Once you hit that limit, you pay full price again - unless you reapply. Some programs renew automatically. Others require you to re-enroll every year. Don’t assume it’s ongoing.Also, the discount only applies to the brand-name version. If your doctor switches you to a generic, the card won’t work. And if your insurance forces a generic substitution, you’ll lose the savings.

Some programs expire after 12 or 24 months. You might get a notice before that happens. But not always. A Reddit user in 2022 shared how their Humira coupon ended without warning - suddenly their monthly cost jumped from $80 to $1,200. That’s why it’s smart to check your card’s expiration date every few months.

Manufacturer Cards vs. GoodRx or Other Discount Cards

GoodRx and SingleCare are pharmacy discount cards. They’re not made by drug companies. They work for both brand and generic drugs. They usually save you 30% to 60%. Manufacturer cards save you 70% to 85% - but only for brand-name drugs.Here’s the trade-off:

| Feature | Manufacturer Copay Card | GoodRx / Pharmacy Discount Card |

|---|---|---|

| Who can use it? | Private insurance only | Anyone - even no insurance |

| Applies to generics? | No | Yes |

| Max savings | 70%-85% | 30%-60% |

| Counts toward deductible? | Usually not - if you have an accumulator program | No - never counts toward insurance |

| Expiration | 12-24 months, may need renewal | No expiration |

| Eligibility checks | Yes - requires insurance info | No - just pay cash |

If you’re on private insurance and your drug is expensive, start with the manufacturer card. If it doesn’t work, or you’re ineligible, switch to GoodRx. Sometimes GoodRx gives a better price than your insurance copay - even without a coupon.

Why These Programs Are Controversial

These programs help you now - but they may hurt you later. Experts like Dr. Robin Feldman say they keep drug prices high. Why? Because if patients pay less out of pocket, they don’t push back when drug companies raise prices. Insurance companies can’t negotiate lower list prices if patients aren’t feeling the pain.A 2016 study found that when manufacturers offered coupons, brand drug sales jumped by 60% or more. That’s because people stuck with expensive drugs instead of switching to cheaper generics. That’s good for the drug maker. Not so good for the system.

That’s why 32 states have passed laws banning accumulator programs. They want manufacturer discounts to count toward your deductible. But federal law hasn’t changed yet. And drug companies are fighting back.

What You Should Do Now

1. Check your drug’s manufacturer website. Don’t wait until your bill arrives.2. Call your insurance company. Ask: “Do you have an accumulator program?” If yes, ask if they’ll waive it for your medication.

3. Ask your pharmacist. They see this every day. They can help you enroll or find alternatives.

4. Set a reminder. Check your card’s expiration date every 6 months. Renew early.

5. Compare prices. Use GoodRx or SingleCare as a backup. Sometimes the cash price is lower than your insurance copay.

If you’re spending more than $300 a month on a brand drug, this program could save you thousands. But you have to take action. Don’t assume your doctor or pharmacy will tell you about it. They’re busy. You’re the one paying the bill.

What If the Program Ends?

It happens. A drug gets a generic. The manufacturer drops the program. Your insurance changes. You might be left with a $1,000 monthly bill overnight.If that happens:

- Ask your doctor if a generic or biosimilar is available.

- Ask about patient assistance programs - some are income-based and don’t require insurance.

- Check if your state has a prescription drug assistance program.

- Call the drug company’s patient support line. Sometimes they offer transitional help.

Don’t stop your medication. Talk to someone. There are options.

Can I use a manufacturer savings card if I’m on Medicare?

No. Federal law prohibits drug manufacturers from offering copay cards to people on Medicare, Medicaid, or other government health programs. This is to prevent financial incentives that could push beneficiaries toward more expensive drugs. If you’re on Medicare Part D, you won’t be able to use these cards - even if your plan has high costs.

Do manufacturer savings programs count toward my insurance deductible?

Usually not. Many insurance plans use “accumulator adjustment programs,” which means the discount from the manufacturer doesn’t count toward your deductible or out-of-pocket maximum. You still have to pay the full amount yourself before your insurance kicks in. Check with your insurer to see if your plan uses accumulators.

How much can I save with a manufacturer copay card?

Most patients save between 70% and 85% off their out-of-pocket cost. For example, a diabetes medication that costs $562 a month might drop to $100 with a coupon. Annual savings can reach $5,000 to $15,000, depending on the drug and your usage. But these savings are capped - once you hit the limit, you pay full price again.

Can I use GoodRx instead of a manufacturer card?

Yes - and sometimes it’s better. GoodRx works for both brand and generic drugs and doesn’t require insurance. It typically saves 30% to 60%. If your manufacturer card doesn’t work, or if your plan blocks it, GoodRx is a reliable backup. Always compare prices at your pharmacy using both options.

What should I do if my manufacturer savings program ends suddenly?

Don’t stop taking your medication. Contact your doctor immediately to ask about alternatives like generics, biosimilars, or other assistance programs. Call the drug company’s patient support line - some offer transitional help. Also, check if your state has a prescription drug assistance program. You may qualify for income-based aid even if you have insurance.

13 Comments

Ashley Elliott

December 7 2025

I just want to say-thank you for writing this. I’ve been using a copay card for my rheumatoid arthritis med for two years now. It went from $1,200 to $95. I didn’t know about accumulators until last year, and my deductible reset because of it. I called my insurer and begged them to waive it-they did. It’s worth the call. Don’t assume it’s automatic.

Chad Handy

December 8 2025

Let’s be real-the pharmaceutical industry is a cartel. They spend billions on lobbying to block generic competition, then turn around and give you a coupon so you don’t notice the price hikes. The real problem isn’t your insurance-it’s that the list price is fabricated. These copay cards are a distraction. They make you feel like you’re getting help while the system keeps inflating the base cost. I’ve seen people on Medicare pay less than people with private insurance because they’re not being exploited by these programs. It’s backwards.

Augusta Barlow

December 9 2025

Ever wonder why every single drug company has a ‘patient support’ page? It’s not altruism. It’s a legal loophole. The FDA lets them do this because they claim it’s ‘access,’ but it’s really just a way to avoid price transparency. They’re not trying to help you-they’re trying to keep you from ever knowing what the drug actually costs. And don’t get me started on how they use your insurance info to track your usage and adjust prices. They’re watching you. Always.

Joe Lam

December 10 2025

You’re all missing the point. If you’re using a manufacturer coupon, you’re part of the problem. You’re enabling price gouging. You think you’re saving money? You’re just making the system more unsustainable. Real solution? Push for Medicare negotiation. Stop relying on corporate charity. You’re not a victim-you’re a participant in a broken system.

Karl Barrett

December 11 2025

There’s a deeper existential tension here: the commodification of health. These programs function as psychological palliatives-they mitigate the financial pain without addressing the structural pathology of pharmaceutical pricing. We’ve outsourced care to market mechanisms, and now we’re surprised when the market prioritizes profit over personhood. The copay card isn’t salvation-it’s a Band-Aid on a hemorrhage.

val kendra

December 12 2025

Just enrolled in my Humira card today-saved me $1,100 this month. Don’t overthink it. If it helps you breathe, take it. Check expiration dates. Use GoodRx as backup. Call your pharmacist-they know more than your doctor sometimes. You’re not broken. The system is. Just keep fighting.

Isabelle Bujold

December 12 2025

As someone from Canada, I can’t believe how complicated this is. Here, we pay $5-$10 for most prescriptions. I know people in the U.S. are stuck with these programs because they have no choice, but it’s heartbreaking. Why does healthcare have to be this way? I hope your government figures it out soon. Until then, I’m glad you have these tools-even if they’re flawed.

Rachel Bonaparte

December 13 2025

Let’s talk about the real agenda. These programs are designed to make you dependent. They’re a slow burn. First, they get you hooked on the brand. Then they make you believe you can’t live without it. Then they let the card expire. And suddenly, you’re paying $1,200 a month. They count on your fear. They count on your ignorance. They count on you not reading the fine print. This isn’t healthcare. It’s psychological manipulation wrapped in a discount card.

Scott van Haastrecht

December 14 2025

My insurance denied my copay card last month. I called them for 47 minutes. They told me it was ‘a compliance issue.’ Then I called the drug company. They said ‘we’re not responsible for your insurer’s policies.’ Then I called my doctor. She said ‘I wish I could help, but I’m just the middleman.’ So I stopped taking my meds for three weeks. I ended up in the ER. Now I’m suing. This isn’t a savings program. It’s a death sentence with a coupon.

Bill Wolfe

December 15 2025

Look, I get it-you’re trying to survive. But if you’re using a copay card, you’re basically saying, ‘I’m okay with being exploited as long as I get my fix.’ That’s not empowerment. That’s complicity. You’re not a patient. You’re a revenue stream. And the drug companies? They’re laughing all the way to the bank. I’m not judging you-I’m warning you. This system is designed to break you. And it’s working.

Ollie Newland

December 17 2025

Been using GoodRx for my asthma inhaler-saved me $40 a month. But my friend’s insulin card expired and she didn’t know until her bill hit $1,400. She cried in the pharmacy. That’s the reality. These programs are like lottery tickets-you win sometimes, but you’re still playing a rigged game. Always have a backup. Always check. Always question. Don’t trust the system.

Rebecca Braatz

December 18 2025

YOU CAN DO THIS. Seriously. I was paying $800/month for my MS med. Found the copay card. Now I pay $65. Called my insurer, asked about accumulators, got it waived. Set a calendar reminder for 6 months out. I’m still alive. I’m still taking my meds. You’re not alone. Go to the manufacturer’s site right now. Do it. Your future self will thank you.

Emmanuel Peter

December 5 2025

This whole system is rigged. Drug companies know you’re desperate, so they give you a $100 copay card so you’ll keep buying their $5000-a-month drug instead of switching to a generic. They’re not helping you-they’re locking you in. And now your insurance won’t even count that discount toward your deductible? That’s not a savings program, that’s a trap.