Generic drugs are the backbone of affordable healthcare worldwide

By 2025, nearly 9 out of 10 prescriptions filled in the U.S. are for generic drugs. In India, over 60,000 generic medicines are produced annually. In Brazil, Turkey, and Egypt, governments are pushing local production to cut import costs. These aren’t just cheap alternatives-they’re the reason millions can afford insulin, blood pressure pills, or cancer treatments. But the landscape is shifting fast. The era of easy profits for generic manufacturers is over. New challenges are rising: stricter regulations, complex new drug types, and supply chain risks. The future of global generics isn’t about price wars anymore. It’s about who can adapt, scale, and build trust.

The market is growing-but not everywhere

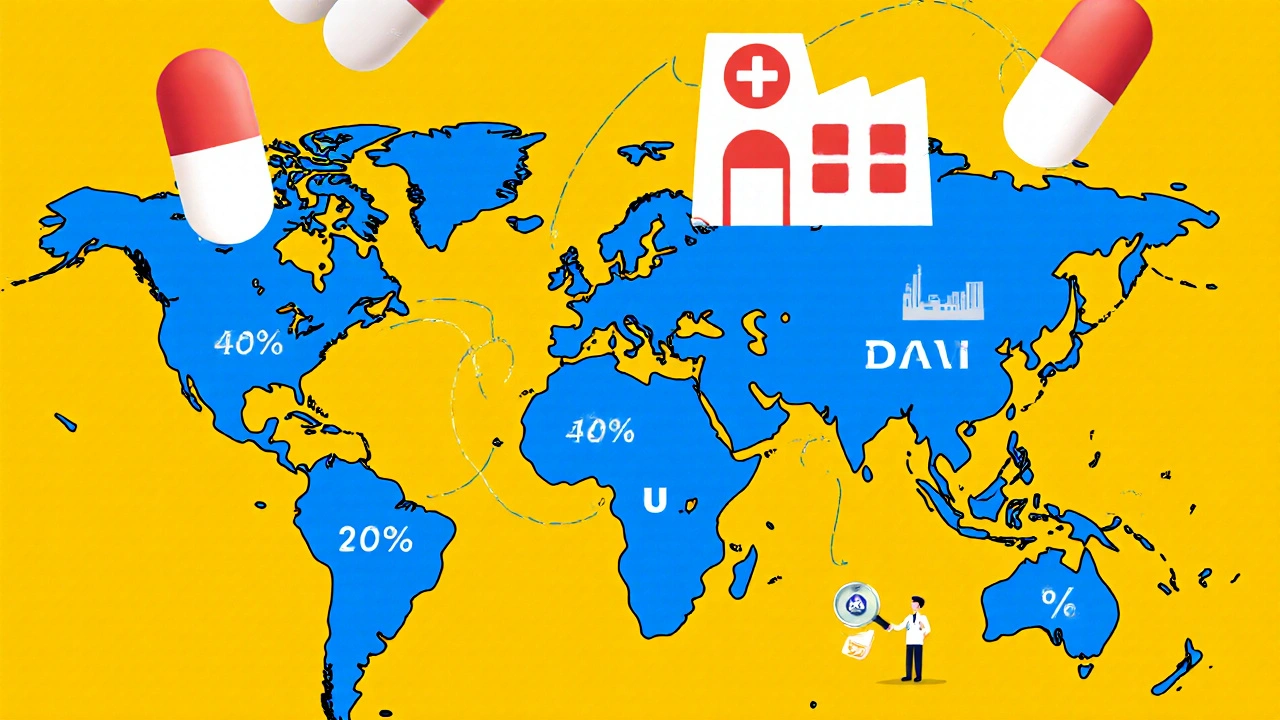

The global generic drug market hit $435 billion in 2023 and is expected to cross $650 billion by 2028. That sounds strong. But growth isn’t uniform. In North America and Western Europe, prices are being squeezed by government agencies and pharmacy benefit managers. Growth here is stuck at 2-5% annually. Meanwhile, countries like India, China, Brazil, and Saudi Arabia are booming. These are called "pharmerging" markets-places where healthcare spending is rising fast because more people now have insurance or government-backed drug programs. By 2025, these markets will add $140 billion in new generic drug spending. India alone supplies 20% of the world’s generic medicines by volume. China makes 40% of the world’s active ingredients. That’s not luck. It’s strategy. Governments in these countries are investing billions to build manufacturing capacity, not just to serve their own populations but to export.

Biosimilars are the new frontier

For decades, generics meant small-molecule pills-like metformin for diabetes or atorvastatin for cholesterol. Easy to copy. Cheap to make. But now, the biggest opportunities are in biologics. These are complex drugs made from living cells, like Humira for arthritis or Enbrel for autoimmune diseases. When their patents expire, they don’t get replaced by simple generics. They get replaced by biosimilars. These aren’t copies. They’re highly similar versions, and they’re harder to make. Producing one takes 10 to 20 times more steps than making a regular generic. Costs? $100 million to $250 million to develop. That’s 50 times more than a traditional generic. But the payoff? Biosimilars can sell for 15-30% less than the original biologic. That’s not 80% off like old generics, but it’s still huge savings for hospitals and insurers. The biosimilar segment is growing at 12.3% per year. Companies that can master this-like Sandoz, Mylan, or Indian giants like Biocon-are the ones winning the next decade. Smaller manufacturers? They’re getting left behind.

Quality control is the silent crisis

Every year, the U.S. FDA issues hundreds of warning letters to foreign drug factories. In 2023, 187 of them targeted generic drug plants. Why? Poor sanitation, falsified data, unapproved process changes. Forty percent of all warning letters in 2023 went to facilities outside the U.S.-mostly in India and China. The problem isn’t that these countries make bad drugs. It’s that the system is stretched thin. Demand is high. Profit margins are low. Some factories cut corners. The FDA can’t inspect every plant. Regulators in Europe and Canada face the same issue. Countries like Saudi Arabia and the UAE are now tightening their own rules to avoid being flooded with substandard products. Egypt just passed a law requiring 50% of essential medicines to be made locally-by 2025. That’s not just about economics. It’s about safety. If trust in generics erodes, patients stop taking their meds. That’s worse than high prices.

Supply chains are a ticking time bomb

China makes 65% of the world’s active pharmaceutical ingredients (APIs). That’s the raw chemical that goes into every pill. India makes most of the finished tablets. But what happens if trade gets disrupted? Or if China shuts down a factory for environmental reasons? Or if a new virus emerges? The pandemic showed how fragile this system is. When lockdowns hit China in 2020, shortages of common generics like antibiotics and heart meds popped up in the U.S. and Europe within weeks. Now, governments are reacting. The U.S. is offering tax breaks to bring API production home. India’s government gave $1.34 billion in 2024 to boost local API manufacturing under its Production Linked Incentive scheme. The EU is doing the same. But building these factories takes years. And it’s expensive. For now, the world still depends on a few key players. That’s a risk no health system can afford to ignore.

Who’s winning-and who’s falling behind

Big generic companies are getting bigger. They’re buying up smaller rivals, investing in biosimilars, and building their own distribution networks. Some are even partnering with tech firms to track drug shipments in real time. Others are moving into specialty generics-drugs for rare diseases or complex delivery systems like inhalers or injections. Meanwhile, small manufacturers are struggling. Profit margins have dropped from 18% in 2020 to just 12% in 2024. Many can’t afford the $100 million needed to enter biosimilars. They’re stuck making old, low-margin pills that are being undercut by even cheaper competitors. The winners? Those who move up the value chain. The losers? Those who think generics are just about cutting costs. The future belongs to those who understand quality, science, and supply chain resilience.

What this means for patients and health systems

Generic drugs will keep saving lives. They’ll keep cutting healthcare costs. But the way they’re made, regulated, and delivered is changing. In rich countries, insurers will keep pushing for biosimilars over expensive biologics. In developing nations, governments will keep pushing for local production to reduce imports. Patients will still get cheaper pills-but the pills might come from a different factory, with stricter testing, and maybe even a new name: biosimilar. The real challenge isn’t price anymore. It’s reliability. Can you trust that your blood pressure medicine today will be the same tomorrow? Can your hospital count on having enough insulin next month? That’s the new question. And the answer depends less on who makes it, and more on how well it’s made.

The next decade will be defined by adaptation

By 2030, generics will still make up over half of all prescriptions. But their share of total drug spending will drop-from 57% in 2024 to around 53%. Why? Because new, expensive drugs-like GLP-1 weight-loss medications-are booming. They’re not generics. They’re not even biosimilars. They’re breakthroughs. And they’re eating up more of the budget. But that doesn’t mean generics are fading. It means they’re becoming more strategic. They’re not just the cheapest option anymore. They’re the smartest option-for patients, for hospitals, for governments. The companies that survive will be the ones who stop thinking like commodity sellers and start thinking like healthcare partners. That’s the future. Not lower prices. Better systems.

Are generic drugs as safe as brand-name drugs?

Yes-when they’re made properly. Generic drugs must contain the same active ingredient, strength, and dosage form as the brand-name version. They’re tested to prove they work the same way in the body. The U.S. FDA requires them to meet the same quality standards. But safety depends on the manufacturer. Factories with poor practices can produce substandard products. That’s why regulators inspect facilities and issue warnings. The drug itself isn’t the risk-it’s the production process.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are made from living cells-like yeast or bacteria-while regular generics are made from chemicals. Living systems are unpredictable. Each batch must be carefully controlled to ensure consistency. That requires advanced labs, strict temperature controls, and complex testing. A regular generic might take 50 manufacturing steps. A biosimilar can take over 1,000. Development costs are 50 times higher. That’s why only large, well-funded companies can enter this space.

Which countries dominate generic drug production?

India and China are the leaders. India produces over 60,000 generic medicines and supplies 20% of the world’s volume by volume. China makes 40% of global active pharmaceutical ingredients (APIs)-the raw chemicals used in pills. Together, they control about 35% of global manufacturing capacity. Other growing players include Brazil, Turkey, and Egypt, where governments are pushing local production to reduce imports.

Why do some countries have higher generic use than others?

It’s mostly about policy. Germany uses generics in 72% of prescriptions because its health system encourages substitution. Italy uses them in only 28% because doctors and patients still prefer branded drugs, and reimbursement rules don’t push generics. In the U.S., generics are used in 90% of prescriptions but make up only 23% of spending because they’re so cheap. In developing countries, generics dominate because they’re the only affordable option.

Will generic drugs become obsolete with new treatments like GLP-1 drugs?

No. New drugs like Ozempic or Wegovy are expensive and targeted. They help a small group of patients. Generics still treat the vast majority-high blood pressure, diabetes, cholesterol, infections, depression. These are chronic conditions affecting billions. Even as specialty drugs grow, generics will remain the foundation of global healthcare. The difference? They’ll be more specialized, more regulated, and more integrated into care systems-not replaced.

10 Comments

Julia Strothers

November 22 2025

Let’s be real-China controls 65% of APIs and the FDA can’t even inspect half the plants? This isn’t about health, it’s about surrender. We’re letting foreign powers dictate what goes into our bodies. And don’t even get me started on India’s ‘quality control’-half those labs are running on duct tape and wishful thinking. This is a national security crisis wrapped in a pill bottle.

Nikhil Purohit

November 23 2025

As someone who grew up in a small town in UP where generics were the only option, I’ve seen how these drugs save lives. But yeah, the pressure to cut costs is insane. My cousin works at a pharma plant in Hyderabad-they’re working 14-hour shifts just to meet quotas. It’s not laziness, it’s survival. We need better regulation, not just more inspections. And biosimilars? Huge opportunity for India-if we stop treating them like just another commodity.

Erika Sta. Maria

November 23 2025

OMG you guys are all so naive. Biosimilars are just Big Pharma’s way of keeping the monopoly alive under a new name. They charge $100M to make something that’s ‘similar’? That’s fraud. And don’t tell me about ‘quality’-the same people who made the original biologic are the ones certifying the biosimilar. It’s all a shell game. Wake up. The real winners? The lawyers who wrote the patents.

Chris Vere

November 25 2025

The shift from price-based competition to system-based reliability is inevitable. What matters now is not how cheap the pill is but whether you can depend on it month after month. This isn't just about manufacturing-it's about trust as infrastructure. When patients stop taking their meds because they fear inconsistency, the cost becomes invisible but catastrophic. We must treat drug supply like water or electricity-essential, regulated, resilient.

Pravin Manani

November 26 2025

From a manufacturing standpoint, the real bottleneck isn’t tech-it’s talent. Biosimilar production requires bioprocess engineers who understand cell line stability, chromatography optimization, and real-time process analytics. Most Indian and Chinese plants are still staffed with technicians trained for small-molecule synthesis. Until we invest in upskilling the workforce-not just building factories-we’re just moving the bottleneck downstream. And yes, this is where India has a shot-if we stop chasing volume and start chasing precision.

Leo Tamisch

November 28 2025

Wow. Just… wow. 🤡 So now we’re all supposed to be impressed that generics are becoming ‘strategic healthcare partners’? Next they’ll tell us the pill bottle has a mindfulness app. Look, I get it. You’re trying to make a commodity sound profound. But let’s not pretend this is innovation. It’s just capitalism with a lab coat. 🥱

Franck Emma

November 29 2025

My dad died because his generic heart med ran out and the replacement took 3 weeks. Don’t talk to me about ‘trust’.

Noah Fitzsimmons

December 1 2025

Oh wow, so China makes 65% of APIs and that’s a ‘ticking time bomb’? 🤦♂️ And you’re surprised? You think the U.S. would let a foreign country control 65% of its ammunition supply? This isn’t pharma-it’s geopolitical negligence. Meanwhile, you’re all sipping oat milk lattes while your insulin comes from a factory that got a ‘warning letter’ last Tuesday. Congrats, you’re living in a dystopia and you think it’s normal.

Eliza Oakes

December 1 2025

Wait-so the ‘future of generics’ is… more regulation, more cost, and more complexity? And you call that progress? 🤨 Next thing you know, your aspirin will come with a 12-page compliance form and a Zoom call with the FDA. Meanwhile, real people are choosing between food and meds. This isn’t evolution-it’s elitist overengineering. The problem isn’t that generics are cheap-it’s that healthcare is broken.

Sammy Williams

November 21 2025

Honestly, I’ve been on generic blood pressure meds for years and never had an issue. My grandma takes 7 different generics-she’s 89 and still hiking. The system’s flawed, sure, but blaming the whole industry because a few factories cut corners is like throwing out the whole batch because one egg was bad.